Chamber’s Position on HB 581: Ensuring Fair and Sustainable Tax Policies for the Community

The Augusta Metro Chamber of Commerce is dedicated to advocating for policies that foster a thriving and economically successful community. Recently, the Chamber has taken an active role in reviewing the Mayor and Commission’s proposed path forward for HB 581, which concerns the floating homestead exemption. As the conversation on this important matter unfolds, we remain committed to serving as an educational resource for both business and residential communities.

Here’s a closer look at the Chamber’s position on the issue:

HB 581 and Its Impact on Tax Relief

The Chamber appreciates the Mayor and Commission’s efforts to explore ways to provide tax relief to homeowners, particularly those who are most vulnerable. We also commend their decision to host public hearings to engage the community in the conversation. While the intent behind HB 581 is clear—providing much-needed tax relief—we believe that it may not be the best solution to achieve the long-term goals of affordable housing, county growth, and sustainable municipal funding.

Key Concerns with HB581 Include:

-

Tax Burden Shift: Freezing homestead assessments and recalculating rollback rates based on the floating exemption could shift the tax burden disproportionately to commercial properties. This would impact both large and small businesses and may create an unsustainable financial strain.

-

Impact on Renters: With a high concentration of multi-family properties in the county, higher property taxes could result in increased rents. This would especially affect vulnerable populations who can least afford such increases.

-

Sales Tax Burden: Introducing a new half-penny sales tax to replace lost revenues could be difficult to pass in a voter referendum and would ultimately place an undue burden on consumers.

-

Slow Property Value Growth: Economic experts predict that home prices will grow at a slower pace in 2025, between 2-4%. This suggests that the proposed tax relief may not be as urgent as it appears.

Chamber’s Advocacy

In light of these concerns, we have urged the Mayor and Commission to opt out of the floating homestead exemption measure. Instead, we continue to advocate for a focus on improving government efficiency and curbing unnecessary spending to ensure that all property taxes are fairly assessed. By doing so, we can ensure that the county can continue to grow at a sustainable pace without placing undue financial pressure on any segment of the community.

While the floating homestead exemption may appear to offer tax relief, its impact on the community could be far-reaching. The Chamber remains committed to providing the public with clear, balanced information so that all citizens—both residential and business—can make informed decisions about the future of our community. Two additional public hearings will take place on February 11, 2025 at 6:00pm at the Warren Road Community Center (300 Warren Road, Augusta) and February 18, 2025 at 11:00am at the Lee N. Beard Commission Chamber in the Municipal Building (535 Telfair Street, Augusta.)

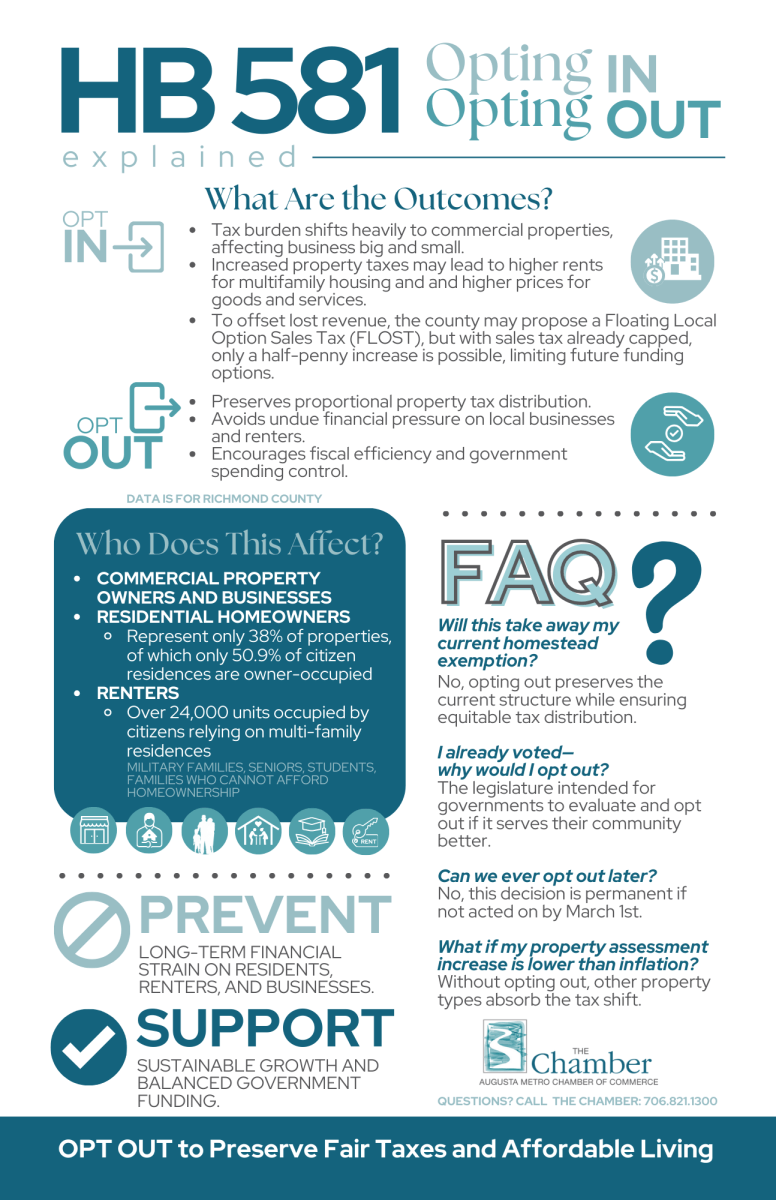

Visual Insight: Infographic on Richmond County’s Tax Burden

For a deeper understanding of the potential impact of HB 581, we’ve included an infographic detailing tax data specific to Richmond County. This data illustrates how the proposed changes could affect both homeowners and businesses in the county. We encourage you to review the infographic to gain a clearer perspective on how tax burden shifts could play out in our local economy.